Source from https://www.propertyguru.com.my/property-guides/how-to-buy-new-house-malaysia-16637

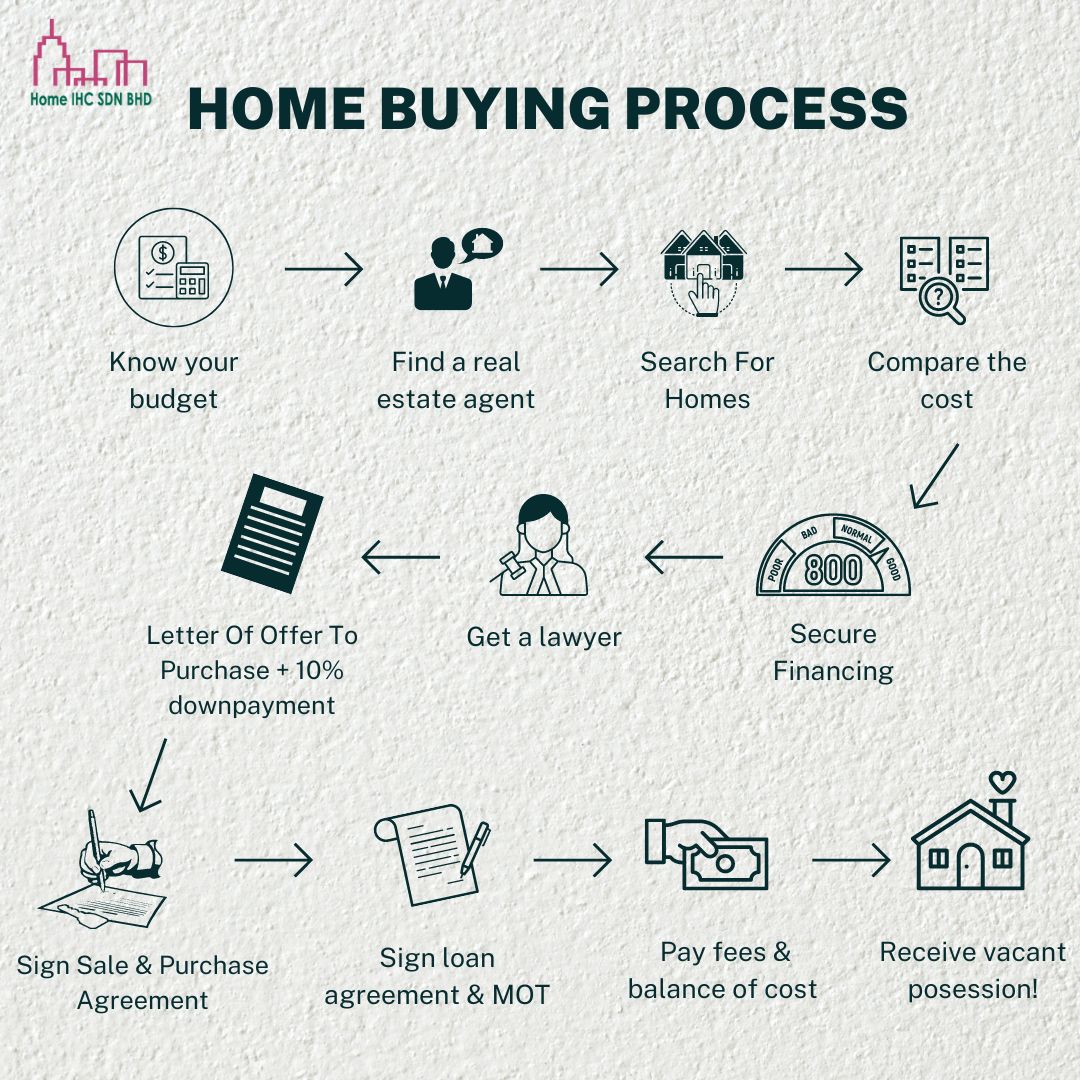

There’s no point in diving into a home search without first knowing what you’re looking for, and when it comes down to it, that begins with your budget.

Do you have enough for the upfront costs?

Item |

Rate |

|

Approx 10% of property purchase price

|

|

|

Stamp duty on Memorandum of Transfer (MOT)

|

1% – 4% of property purchase price

|

|

Stamp duty on Sale and Purchase Agreement (SPA)

|

RM10 per stamping

|

|

Stamp duty on loan agreement

|

0.5% of loan amount

|

|

Real estate agent fees

|

3% of property purchase price

|

|

Mortgage insurance (MRTA/MLTA)

|

Subject to your situation/needs

|

How much does a house cost in Malaysia?

Property prices in Malaysia vary greatly depending on the type of property and the location. Median property prices range between RM300,000 and RM500,000. Terrace homes range between RM300,000 and RM800,000, while condominiums/apartments range between RM300,000 and RM600,000.

Of course, states like Selangor, Penang and Johor lean greatly towards the pricier end of the spectrum.

How much is the down payment on a house in Malaysia?

The minimum down payment on a house in Malaysia is typically 10% of the property purchase price. You’re welcome to pay more upfront if it’s within your means.

The first part of a down payment is usually paid as part of an earnest deposit. In most cases, that’s a non-refundable 2% payment.

Do you have extra cash for miscellaneous fees and charges?

On top of the fees listed above such as earnest deposit, down payment, stamp duties and agent fees – you should make sure to have a cash buffer on hand for other fees that you’ll encounter throughout the process.

These include bank processing fees, legal fees for the SPA and loan agreement and property valuation fees if applicable.

Can you afford to pay the monthly installments?

That’s the upfront costs alone, now let’s look at the bigger picture – can you afford this property long-term?

The monthly instalment depends on:

– Your property purchase price

– Type of home loan you have (Term, Flexi, Semi Flexi?)

– Tenure of the loan (typically 35 years or until 70 years old)

– Home loan interest rate

With so many factors that go into the picture, a home loan calculator can help you figure out how much your monthly installment may cost.

Do you have a secure financing?

It’s important to understand that all banks will rely on your CCRIS Report as well as your CTOS score to assess your suitability for a loan. That doesn’t necessarily mean that if one bank rejects you, others will too, but it does offer a good insight into the decision making process.

In addition, you’d also need to make sure that you’re not stuck with too many debts. This will cause your Debt Service Ratio (DSR) to reach unhealthy levels, instead of the recommended 30%-40% range.