Wanting to buy your first property is always an exciting, and slightly nerve-racking, experience! Here are some reasons why:

- You’ve done your research to find the perfect area surrounded by plenty of amenities (and the neighbours aren’t weird in any way).

- You’ve prepared a solid budget that maps out your repayments, savings, and miscellaneous expenses.

- You’ve also selected the right bank that will provide you with a 90% margin of finance with an attractive interest rate.

“Now, what could possibly go wrong,” you think. Well, A LOT, as it seems!

Before you can even take the last step to seal that sweet deal, you discover some additional ‘hidden fees’ you overlooked. Yep, apart from the property’s down payment, there’s also the following:

- Legal fees for the Sale and Purchase Agreement (SPA) and loan agreement

- Real estate agent’s commission

- Stamp duty Malaysia fees

Suddenly, that carefully planned budget of yours is in chaos as you realise that you don’t have enough money to purchase your dream home after all. Boooo!

How Am I Supposed To Know What The Rates Are?

Well, if you wanna make sure the scenario above doesn’t apply to you, you’d better check out the list of rates we’ve compiled below for your reference.

They’ll show you what to expect when it comes to the additional payments you need to make. Hopefully, you won’t be caught off-guard and have to scramble to raise enough funds on time. You’re welcome!

What Is A Sale and Purchase Agreement?

A Sale & Purchase Agreement (SPA) is a legally binding agreement between a seller and a buyer, outlining the details of the transaction such as terms and conditions, price of the property, and all the important details the seller should know about.

The SPA is a mutual agreement between both parties, hence, it cannot be further negotiated or amended, and canceling it will result in a 10% penalty of the purchase price. Always make sure you fully understand it before signing on the dotted line!

Other details you can find in the SPA are the manner of payment, defect liability period, house/unit plan, vacant possession, and various clauses.

What Is Stamp Duty?

Stamp duty is also known as a transactional tax, or fee, for stamping transactional documents such as loan agreements, tenancy agreements, and documents pertaining to property transfer, including the SPA!

It’s also a legal requirement and must be stamped within 30 days of the signing of the SPA, or you will need to pay a penalty of 5%-20% of the deficient duty.

How To Calculate Stamp Duty Fees

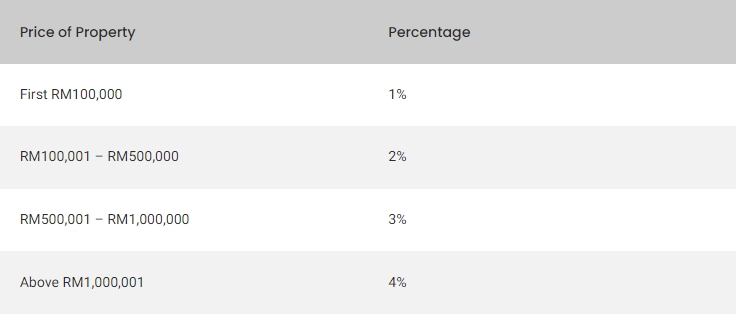

For Instrument of Transfer – Memorandum of Transfer (MOT) or Deed of Assignment (DOA):

For example, the purchase of a property worth RM500,000 would put you in the first two tiers, hence, 1% of RM100,000 and 2% of RM400,000.

- 1% of RM100,000 = RM1,000

- 2% of RM400,000 = RM8,000

- Total stamp duty fees: RM9,000

Stamp duty also applies for loan agreements, but it is capped at a maximum rate of 0.5% of the full value of the loan.

By purchasing an RM500,000 property with a 90% loan (since 10% of it will be the down payment), the loan amount would be RM450,000.

- 0.5% x RM450,000 = RM2,250 total stamp duty fees

What Are Legal Fees?

Legal fees are part of the SPA and is basically a charge for engaging legal assistance for the purchase of a property. Typically, the solicitor will be assigned by the seller, but should the buyer choose to pick their own representative, it is allowed.

At times, developers may also choose to absorb the legal fees to reduce the buyer’s financial worries.

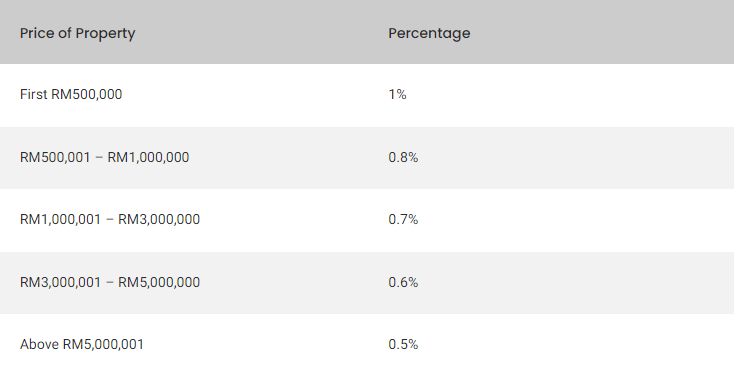

How To Calculate Legal Fees

The legal fees are calculated based on a percentage of the buying price of the property, which can be anywhere from 0.5% to 1%, depending on the value of the property.

For a property bought at RM600,000, the legal fees would be:

- 1% x RM500,000 = RM5,000

- 0.8% x RM100,000 = RM800

- Total legal fees = RM5,800

Budget 2021 Stamp Duty Exemption For Your First Home

On 6 November 2020 during the tabling of Budget 2021, the Malaysian government announced stamp duty exemptions for first-time homebuyers!

Full stamp duty exemption will be given to both instrument of transfer and loan agreement for the purchase of a first home worth not more than RM500,000.

This exemption will be for the Sale and Purchase Agreement completed between January 2021 to 31 December 2025.

Yup, that means it’s full exemption for the stamp duty on both instrument of transfer and loan agreement if your property price is RM500,000 and below!

That’s a maximum of RM11,250 savings! The detailed calculation as follows:

Stamp duty for instrument of transfer + Stamp duty on loan agreement = Total stamp duty to be paid

- [(First RM100,000 x 1%) + (Next RM400,000 x 2%)] + 0.5% of loan amount, assuming 90% of property price (RM450,000)

= (RM1,000 + RM8,000) + (0.5% x RM450,000)

= RM9,000 + RM2,250

= RM11,250

Additionally, the stamp duty will also be waived for transfer instruments and loan agreements for buyers of abandoned housing projects, and new developers who will take on said projects. The exemption will be extended until 31 December 2025 as well.