Here’s How You Can Buy Vacant Land In Malaysia

From: https://www.propertyguru.com.my/property-guides/buy-vacant-land-malaysia-13369

Vacant land can be an attractive purchase for some investors. But buying land also comes with substantial risks, and some tricky regulation to navigate.

The origins of land laws in Malaysia can be traced back to colonial times, with a number of evolving laws dictating the transfer of ownership.

In 1965, an act was introduced to streamline all the land transactions in Peninsular Malaysia – the National Land Code 1965 (NLC 1965).

This joined national land laws in Peninsular Malaysia created in 1963, under the National Land Code (Penang and Malacca) Titles Act, which covers Penang and Malacca.

Both these systems use something known as the Torrens system of ownership. It’s important to briefly explore that system in order to understand land ownership in Malaysia.

What Is The Torrens System Of Land Ownership?

The Torrens System is a system of land ownership and transfer in which the national government is responsible for managing and recording the rightful ownership of land.

Originating from an Australian system designed by Sir Robert Torrens in the 19th century.

This system essentially states who is the arbiter (this is a fancy term for ‘a person who has the ultimate authority in a matter’) of land ownership.

That means Malaysia’s government is the authority on land ownership within Peninsular Malaysia, and that all valid land purchase must include official registration to be legally binding.

What Are The Different Types Of Land In Malaysia?

Different types of land come with different regulatory approval needs and understanding. When we’re talking about buying land, it’s important to know the four key types, and what vacant land means:

- Residential Land

Flagged for development of, or use by, residential property such as apartment or terrace houses. - Agricultural Land

Flagged for the development of, or use as, agricultural land such as palm oil plantations. - Commercial Land

Flagged for development of, or use by, commercial developments such as shopping malls, offices, or other business premises. - Vacant Land

Land which is currently not registered for a specific purpose under residential, agricultural, or commercial use.

Vacant land is likely to be cheaper than a comparative area with registered uses as noted above, essentially due to its undeveloped nature.

That means creating a return on investment (ROI) from vacant land can require substantially more work than other land types.

Converting that vacant plot to another land-use type is governed on a state-by-state basis, and will incur costs.

You should consult the appropriate state policy to understand what those costs might be.

Finding The Right Vacant Land

Finding the right vacant land usually means a land search that takes into account a number of different factors. First up, you should consider the type of agreement under which land is held.

Freehold – outright ownership for an undefined period of time.

Leasehold – ownership held for a set period of time up to 99 years, with the lease expiring or requiring renewal.

There are certain areas of land in Malaysia which can only be sold or purchased to Malay individuals or corporations under the Malay Reservations Enactment, and you should be aware of this fact when searching for land.

Surveying The Land

A survey is an important part of a valid land transaction.

This is a professional method that’s used to identify the boundaries, lines, corners and distances of a particular piece of land in order to determine the legal ownership.

If the seller doesn’t have a complete and updated survey from a reputable authority, you should ensure you undertake one before you agree on a purchase in order to avoid any unnecessary disputes.

You can also apply for the certified plans from the Department of Surveying and Mapping Malaysia (JUPEM).

It’s important to check existing plans to ensure that there are no current restrictions or planning permission(s) in place.

It’s also crucial to have a well-defined plot of land as part of your purchase agreement.

This means ensuring that the boundaries of the vacant land are clearly understood and recognised by both parties as part of the agreement.

Agreeing On The Purchase Price

If you’re happy with the vacant land you want to buy, it’s all about agreeing on the price.

If it’s feasible, you can request for the prices on a number of similar plots to assess the price per square foot offered.

Obviously, vacant land can vary in value, with the location playing the most important factor.

An acre of land in mountainous rural Perak is likely to cost a lot less than a prime bit of lakeside land in Selangor.

You’re not legally obliged to employ a lawyer in a land transaction agreement, but like any other transaction, it’s best to ensure that correct legal procedure is followed with the help of a professional.

Complete The Documentation

The transaction is completed by submitting a transfer of land document. That notifies the relevant Land Office of the purchase, and releases the certificate of ownership.

The Land Title, otherwise known as the Issue Document of Title, is the official document registering the owner of land.

It’s the most important document in any land transaction, as it’s the official register under Malaysia’s land ownership legislation that ensures your ownership is legal and recorded.

To complete the transfer of ownership, you must inform the relevant official department under the oversight of the Department of Director General of Lands and Mines.

There are two noted types of land titles:

- General Registry Titles – held under the Registry of Land Titles for land exceeding 4 hectares.

- Land Office Titles – held under the Land Office for areas below 4 hectares.

With the purchase complete, and the land now legally registered in your name, it’s time to consider your next step.

You’re now the proud owner of a vacant plot of land, ready to convert into a lucrative apartment complex or your very own private theme park (hey, nobody’s judging)!

It’s really up to you (and the regulatory body responsible for approval) to decide what comes next.

What Is The Difference Between Home and Land Financing?

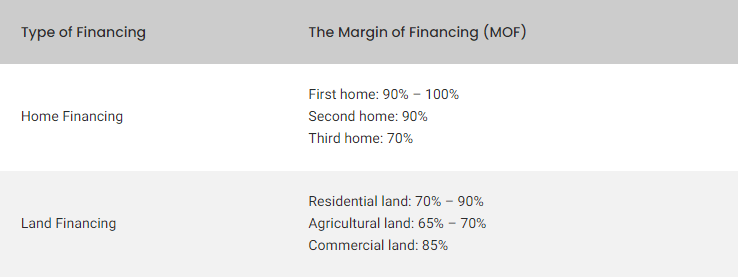

When looking to purchase a home or land with a bank loan, you must first review the Margin of Financing (MOF) or also known as the Loan-to-Value (LTV) ratio.

It is a percentage of the property’s value that the bank offers as loan financing. MOF rates are typically different for home or land financing.

*MOF is also influenced by credit score

When comparing the various MOFs available, there is a significant price difference between the down payment required for home and landing financing. For example, suppose you receive the minimum MOF for the purchase of a first home and residential land, both of which are priced at RM450,000. Let’s look at the math to determine the down payment:

- Home down payment of 90% MOF = 10% x RM450,000 = RM45,000

- Land down payment of 70% MOF = 30% x RM450,000 = RM135,000

So, if you want to get a bank loan to buy land for the same price as the house, you’ll have to pay an additional RM90,000! That also means you have a significant capital to prepare.

In terms of loan processing, both are the same because they fall under real estate financing. What distinguishes the two is the previously mentioned MOF, as well as the interest rate set by each bank.

How to Buy Land in Malaysia?

The following are the steps to take when applying for vacant land financing in Malaysia with a bank.

- Verify the status of the land first to avoid future problems or misunderstandings.

- Go see the land you want to buy for yourself, and use the title number to confirm the land plot.

- Look for a suitable bank that will accept your land loan financing application.

- Prepare all required documents, such as identity document – a copy of one’s identity card for Malaysians, or a copy of one’s passport for MyPR for foreigners.

- Proof of purchase – Sale and Purchase Agreement (SPA) or develop order form.

- Income documents – The latest 3 months’ salary slip, latest 6 months’ commission statement, or business bank statement, depending on employment status.

- Prepare to pay related charges, such as:

- Processing fees

- Service charges

- Stamp duty

- Legal fees

- Land insurance/Takaful

- Finally, go to the bank and apply for a loan by filling out all the necessary application forms, then wait for their response.

If you work for the government or are a civil servant, you can apply for a government housing loan or LPPSA. One of the loan options is to purchase land for the purpose of building a house. There are numerous benefits to obtaining to loan!

Whether you’re building a private theme park or developing something of a more residential disposition, land purchase and conversion can be a big step.