Malaysia Property Buying Guide for Foreigners in 2022

From: https://www.iproperty.com.my/guides/foreigners-buying-property-malaysia-complete-guide-12332

Are you an expat looking to call Malaysia home?

Check out our detailed investment guide which lays out the foreign ownership process, costs involved as well as the latest information on Malaysia My Second Home (MM2H) and Premium Visa Programme (PVIP).

Over the past decade, quite a few expatriates in Malaysia have opted to purchase a residential property either as a second home or for retirement purposes.

A haven for many things, Malaysia is one of the most favoured property markets in Southeast Asia, particularly in the past decade. Recently, the local media reported that Malaysia’s foreign buyers accounted for 10% to 15% of new and second-hand transactions in Malaysia’s largest cities. Many of these properties were residential units purchased as second homes, either for retirement or investment purposes.

If you are one of those who have been smitten by the idea of putting down roots or expanding your investment portfolio in this country, here are some essential guidelines that can help you navigate your ventures in buying a house in Malaysia.

1. Can foreigners buy a property in Malaysia in 2022?

The National Land Code (NLC) 1965, one of the primary property laws in Malaysia, defines a foreigner as any natural citizen who is not a permanent resident of Malaysia. In principle, foreigners can own any type of property (residential unit – both landed and highrise, commercial property and land, industrial property and land). The NLC also states a similar provision for foreign companies in acquiring property or land in this country.

As Malaysia is governed under a federal system, land matters lie within the state government’s jurisdiction. The rules in the states of Peninsula Malaysia differ from those of Sabah and Sarawak.

Each state has implemented different regulations governing foreign property acquisition i.e. types of property and application procedures. However, there are three types of properties that foreigners are not eligible to purchase:

- Properties built on Malay Reserved land

- Low and medium-cost residential units as defined by the state authorities

- As determined by state authorities, properties distributed to Bumiputera interest in any development project.

Foreigners are also not allowed to purchase agricultural land. Nevertheless, in respect of building land or agricultural land gazetted for development, they may do so after receiving consent from the relevant state authority.

2. How to buy a property under MM2H in 2022

Unlike other countries, Malaysia offers a special avenue for foreigners to purchase homes via Malaysia My Second Home (MM2H) programme. The scheme provides a renewable visa (5-year maximum) and applies to all the states in Peninsula Malaysia and Sabah (Sarawak has its own rule and requirement as the state controls their immigration). To learn more, check out this link: Sarawak MM2H (S-MM2H)

You will need to be sponsored by a Malaysian citizen and in Peninsula Malaysia, a registered MM2H agent can replace a citizen sponsor.

As MM2H visa holders, you will enjoy some benefits when it comes to owning houses in Malaysia, which include discounts on certain types of properties available in the market.

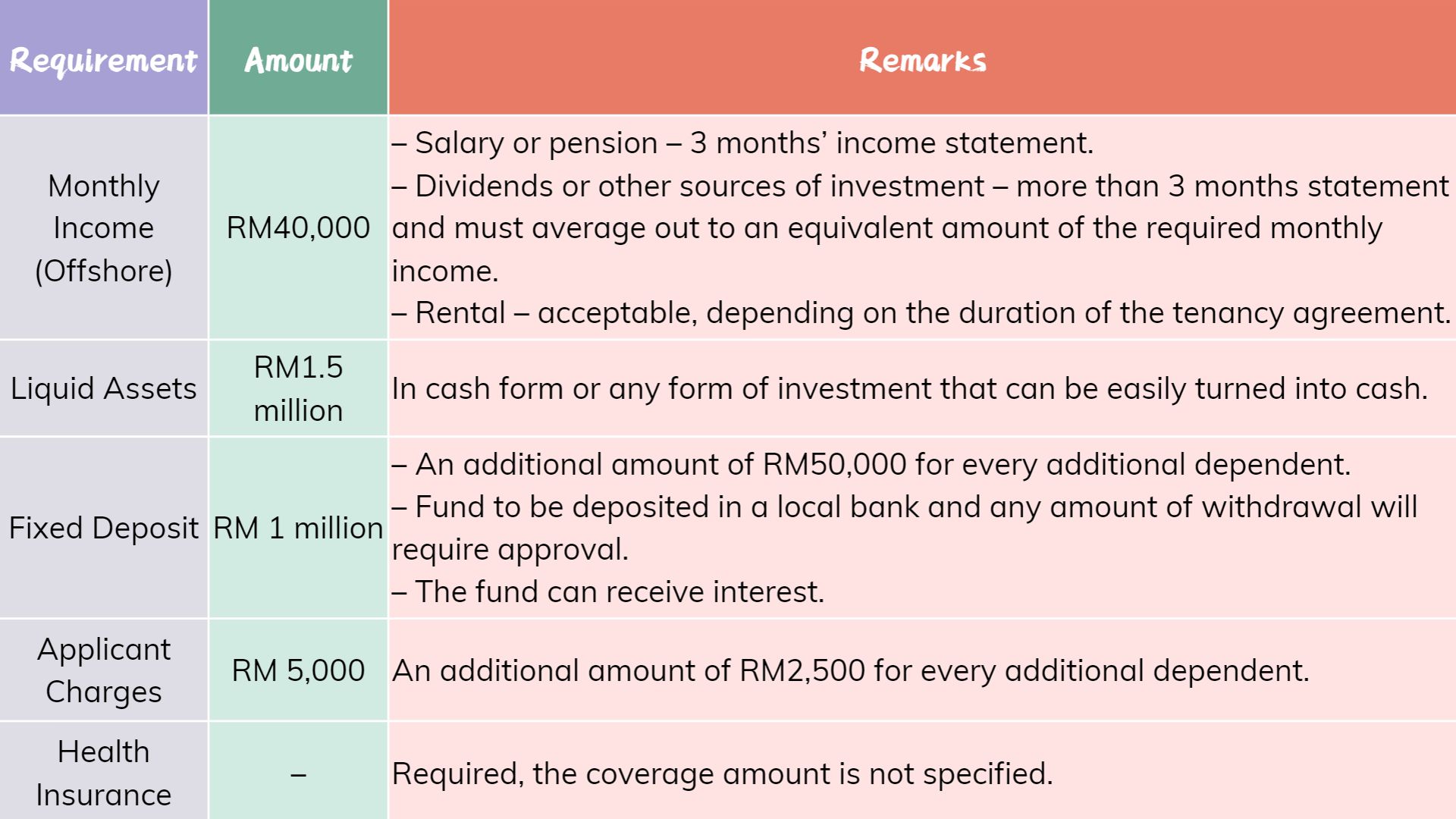

The following are the revised requirements as of August 2021, applicable for those aged 35 and above:

In addition to the above, MM2H visa holders must be in the country for at least 90 cumulative days in a year.

Can a foreigner buy a property without MM2H?

In September 2022, Malaysia introduced a Premium Visa Programme (PVIP), a long-term residency visa that enables foreign investors and entrepreneurs to live, work or study in this country.

Open to all age categories, the programme provides visa approval for up to 20 years (valid for 5 years and issued at 5-year intervals up to a maximum of 4 times) and foreigners will be able to purchase real estate for residential, commercial or industrial purposes.

There are two main conditions a foreigner must meet to be eligible for PVIP:

1. An offshore income of RM40,000 per month or RM480,000 annually

2. A fixed deposit account of RM1 million with a licensed bank in Malaysia

Source: Immigration Department of Malaysia

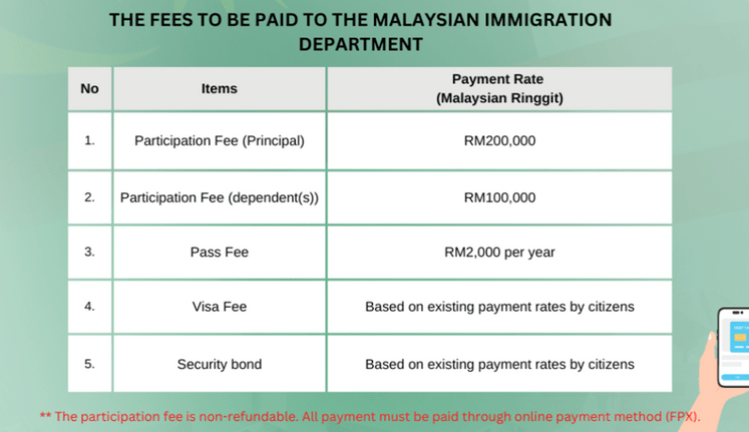

All applications are required to be made through an authorised consultant or agency appointed by the Immigration Department of Malaysia. The participation fee for an applicant is RM200,000, while for every dependent is RM100,000. Payment of 10% initial participation fee of RM200,000 must be paid before the PVIP consultant/agency submits the online application. The remaining balance of the participation fee, pass fee, visa fee and security bond will be paid once the online application is approved.

The following documents also needed to be provided to the PVIP consultant/agency that will be uploaded through the online application:

- The biodata page of the passport

- The Certificate of Good Conduct

- Resume, including the latest 3 months’ pay slip

- Birth Certificate/legal documents (if accompanied by children)

- Marriage/ Divorce Certificate

- Letter of verification from Medical Specialist/General Practitioner

- Approval from Royal Malaysian Police for security screening.

All documents and certificates must be in English or translated into English, certified by the Malaysian Embassy/Consulate.

3. Minimum property price for foreign investment in 2022

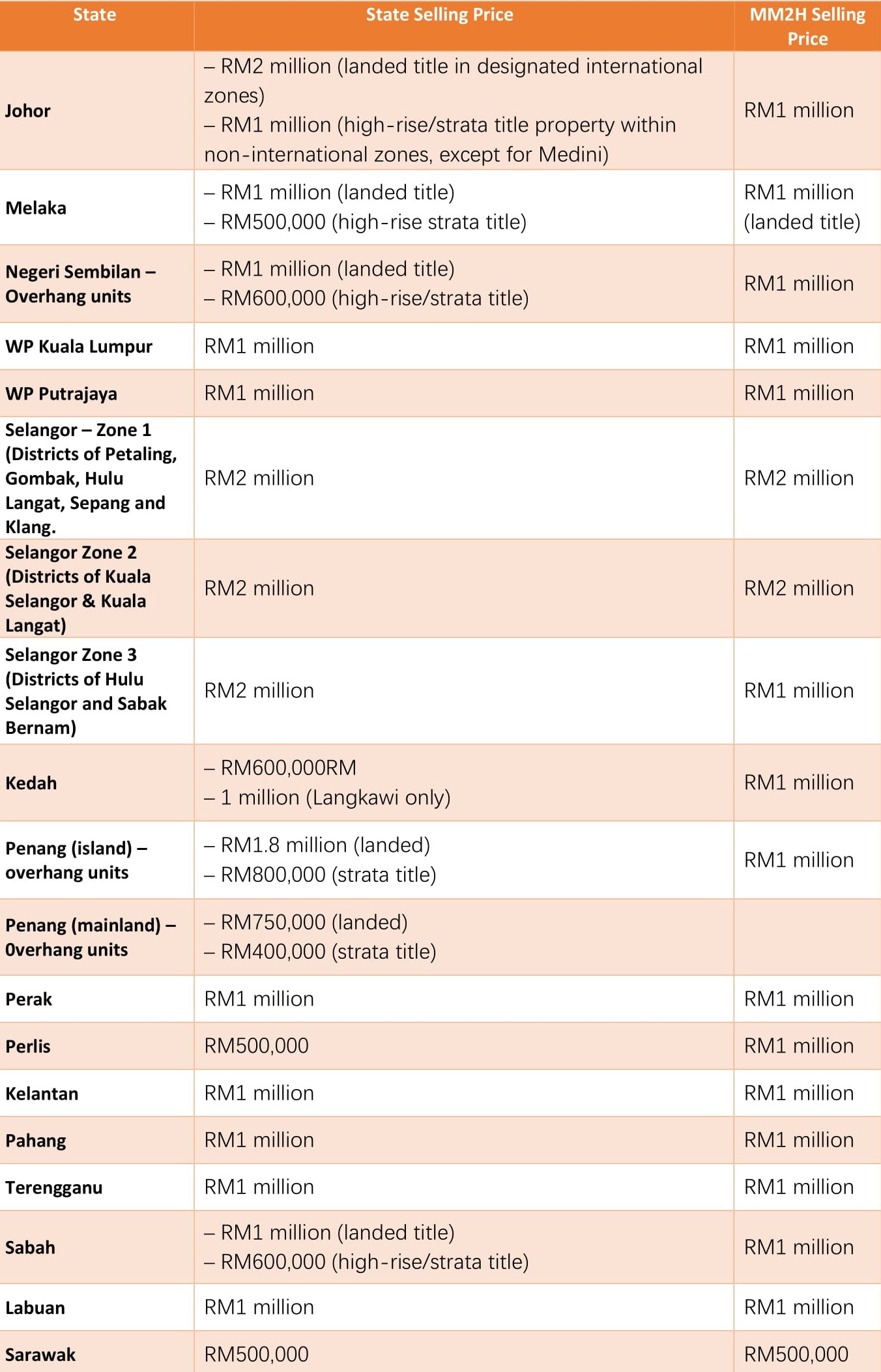

Generally speaking, a minimum purchase value of RM1 million is applied to all kinds of property in almost every Malaysian state, except for 3 (refer to the table below). Now, you probably are asking some of these questions, such as what are the property prices in different states? Which cities have the most expensive houses?

It is safe to say that the average property price in Perak will not cost as much as in Selangor, but here is a quick reference of all the state’s minimum selling prices along with the prices available under the MM2H programme (residential properties only).

NOTES:

1.In the state of Selangor, foreign buyers are prohibited from a) Purchasing landed residential properties unless said property is issued with a landed strata title (e.g. gated community); b) Buying auction properties and c) Purchasing agricultural land.

2. Overhang units are defined as residential units that have received certificates of completion and compliance but remain unsold for more than nine months after being launched.

4. How to buy a property in Malaysia as a foreigner?

Although the procedure of buying a property varies from agent to agent or from developer to developer, here are the common steps taken when a foreigner decides to buy a property in Malaysia:

- Step 1 – Sign the developer’s sales form or the offer to purchase form with the vendor for sub-sale transactions.

- Step 2 – Apply for financing to purchase the property. (The loan approval process varies from bank to bank, and the approval timeline is subject to the type of property that is purchased e.g. newly launched, under construction, or completed)

- Step 3 – Provide the following documents to the solicitor:-

(i) photocopy of the passport

(ii) correspondence address and contact number(s)

(iii) income tax number of the Foreign Purchaser and the place of submission of the income tax (applicable for subsale property purchase only) - Step 4– From the date of signing the sales form (or offer to purchase), sign the Sales & Purchase Agreement (SPA), deed of the mutual covenant (if applicable) and other transactional documents. Pay the 10% deposit to the developer/vendor

- Step 5 – Solicitor to apply for state authority consent. Purchaser to provide the following documents to the solicitor:

(i) One (1) certified true copy of the SPA

(ii) One (1) certified true copy of the Foreign Purchaser’s passport

(iii) One (1) certified true copy of the constitution (if the purchaser is a foreign company)

(iv) Latest quit rent and assessment receipt of the property (to be provided by the vendor)

(v) Application form under Section 433B of the NLC - Step 6 – Pay the balance purchase price in accordance with the Third Schedule of Schedule H Housing Development (Control And Licensing) (Amendment) Regulations 2015 (“Schedule H”) or the SPA.

- Step 7 – Pursuant to Schedule H, the developer shall deliver vacant possession of the property within 36 months from the date of the SPA (or such later date as may be approved by the relevant authority). Upon delivery of vacant possession, a certificate of completion and compliance has to be issued and if it is a high-rise property, the strata title has to be applied by the developer. In the case of a sub-sale transaction, the vendor shall deliver vacant possession to the purchaser in accordance with the terms of the SPA.

5. Can a foreigner obtain a mortgage in Malaysia?

According to Bank Negara Malaysia (BNM), under its Frequently Asked Question (FAQ), a non-resident (foreigner) is permitted to borrow in ringgit to finance or refinance activities in the real sector in Malaysia, including the purchase of immovable property. So yes, foreigners can qualify for home loans in Malaysia. However, access to mortgages in Malaysia very much depends on the individual’s financial standing, the purpose of the purchase and the type of property.

Home financing options

For starters, obtaining a home loan when buying a house through MM2H is indeed a less complex process, as it is a well-established government programme that provides a visa of 5 years. Therefore, banks will be less concerned that you might suddenly move out of the country with an outstanding loan.

If you are not under the MM2H programme, your ability to access a mortgage will vary, depending on whether it is from a local or foreign bank in Malaysia. According to an officer in CIMB bank, unless you are a high nett individual (having RM1 million worth of assets), you may need to be a resident in Malaysia for 5 years or more. In addition, you might also require other forms of assets (savings, stocks) in Malaysia that can be used as collateral to obtain a housing loan. Local banks may also have different procedures for houses bought from developers (ranging from newly launched, under construction and completed) and secondary market (subsale).

As for foreign banks, an HSBC mortgage specialist shared that the requirements of a foreign applicant (borrower’s loan eligibility and submission of documents) are quite similar to a Malaysian applicant. However, the margin of finance would also vary between 60% – 80% depending on if the borrower is a non-resident or resident foreigner in Malaysia.

6. How much do you need to buy a house in Malaysia?

Below are a few significant closing costs that you need to include in your property purchase planning:

Stamp Duty

Stamp duty is the tax placed on your property documents during the sale or transfer of the property. The tax includes:

- stamp duty on the Sale and Purchase Agreements (SPA) of your property – this costs only RM10

- stamp duty on the instruments of transfer – Memorandum of Transfer (MOT) or Deed of Assignment (DOA). The stamp duty is calculated based on a tiered system as shown in the table below.

- stamp duty on your loan agreement – a flat rate of 0.5% of the total loan.

Stamp duty rates for properties valued at more than RM1 million were increased from 3% to 4% as of January 1, 2019.

Legal Fees (For SPA & Loan Agreement)

The legal fees for preparation of the Sale and Purchase Agreement are calculated as a percentage of the property purchase price, varying from 0.25% up to 1% depending on the value of the homes.

Real Property Gains Tax (RPGT)

This may not be a purchasing cost, but foreign buyers should take note that Real Property Gains Tax (RPGT) will be charged on the profit gleaned from a property disposal (in the future). Should foreigners sell a property within the first five years of owning it, they would be liable to pay RPGT at 30% of the chargeable gain, whereas if they sell of the property in the sixth year onwards, they will only have to pay 10% RPGT.

7. Can a Non-Malaysian inherit a property in Malaysia?

The short answer is yes. Based on the law, if there is a will, the executor will need to apply for probate (a legal process to carry out the remaining wishes of a dead person’s will) that is required to distribute the property. If a written will is absent, the beneficiaries will need to apply for a Letter of Administration (LAD). Both processes are to be submitted to the High Court of Malaysia.

Similarly, the NLC under Section 433B (1)(e) also states that a foreigner can own and inherit property in Malaysia only after he has obtained approval from the state government. Make sure to read Property inheritance in Malaysia: Related laws and applications for letters of administration

8. Is buying a property in Malaysia a good investment?

With everything that is currently happening in Malaysia, both on the economic and political front, you are probably thinking, why even bother right? And with more digital investment options coming into play (cryptocurrency, NFTs, metaverse real estate), buying a property, especially for investment, may seem unnecessary.

Nevertheless, investing in a property is still one of the best investment vehicles to deliver capital gains in the long run and the Malaysian residential market remains appealing to buyers from across Asia, particularly China and Japan.

A recent property survey, conducted with nearly 350 real estate agents nationwide, further affirms that more than two-thirds of the respondents expect offshore buying of Malaysian property to return to pre-COVID-19 levels within 18 months – that is, by the end of 2023.

Malaysia has also been a preferred choice for many expatriates who plans to migrate or settle down with their families. Many areas within Klang Valley have been in constant demand, especially properties in the vicinity of reputable international schools. Make sure to go through top neighbourhoods with international and private schools in Klang Valley.

As foreigners are allowed to invest and own properties in Malaysia, the purchased property can be easily leased out or sold in the event the homeowner or investor decides to leave Malaysia. Moreover, demand for properties in the vicinity of such schools has been moving up in tandem.

However, if Malaysian property is disposed of with capital gains, it will be subjected to capital gains tax or real property gains tax.

What is the current economic situation in Malaysia?

According to BNM, while Malaysia continues its transition into the endemic phase by reopening its economic activities, the country registered a stronger Gross Domestic Product (GDP) growth of 8.9% in the second quarter of 2022 (first quarter 2022: 5.0%). This is due to the increase in domestic demand, underpinned by the steady recovery in labour market conditions.

In terms of financial conditions, loan disbursements remained robust amid strong loan demand, particularly for the purchase of cars and houses. Overall, loan repayments for both the business and household segments have been encouraging.

What about the Malaysian property market?

The property market is also on the right track, progressing at a cautious pace while being perceptive of property buyers’ priorities. The National Property Information Centre (NAPIC)’s Property Market Status Report (First Half of 2022) states that the residential sector had an increase of 26.3% in transaction volume and 32.2% in transaction value compared to the same period in 2021. Four major states, namely Penang, Kuala Lumpur, Johor and Selangor were the main contributors to this transaction volume, while terraced houses dominated the residential new launches.

In terms of Malaysian average house price, NAPIC reported that the median house stood at RM320,000, 8.4% higher than its review period in 2021. This upward movement of median prices suggests an observation that there are property buyers who have solid financial footing with an appetite for higher-priced properties.