Real Property Gains Tax (RPGT) in Malaysia (2021)

UPDATED 13 APR 2021 – BY TEAM LOANSTREET

Real Property Gains Tax (RPGT) is a form of Capital Gains Tax that homeowners and businesses have to pay when disposing of their property in Malaysia. Which means that if one day you decide to sell your house, you have to pay taxes on the profit (gains) if you have any.

If you sell your house with a loss you don’t have to pay any RPGT because you didn’t make any profit. If you made a profit you need to make sure you pay the RPGT within 60 days of the sale. You can pay the RPGT by paying a fee for the solicitors of the sale. Paying yourself is also possible if you prefer that instead of dealing with a lawyer you can fill in the necessary forms for the Inland Revenue Board. Further in the article, we will talk about handy tools, how it is calculated and exemptions.

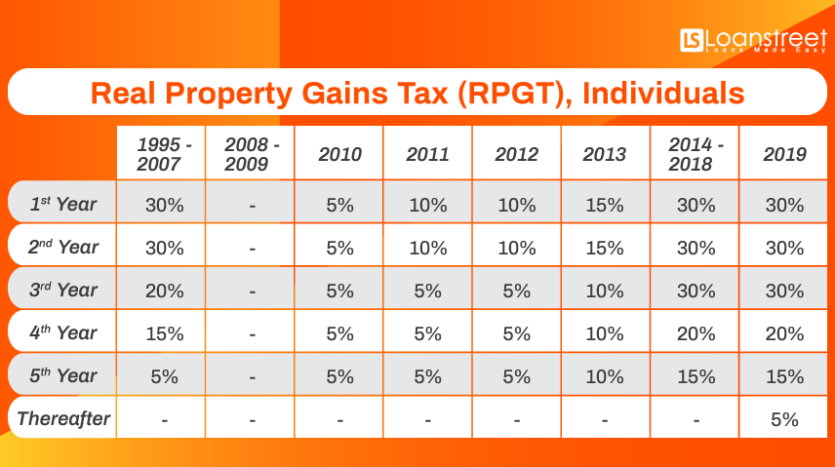

Now, here is some history about the RPGT. It was suspended temporarily in April 2007 to December 2009 and reintroduced in 2010. In 2014, the RPGT was increased for the fifth straight year since 2009. Fast forward to 2019, the RPGT rates have been revised. Now, there’s about to be another revision to the RPGT for under Budget 2020, as well as Exemption Order for 2020.

But first…

RPGT rates classification

The following is the RPGT rates effective from 1 January 2019:

| DISPOSAL | Citizens / PR | Non-Citizens | Companies |

|---|---|---|---|

| 1) LESS OR EQUAL TO 3 YEARS | 30% | 30% | 30% |

| 2) LESS OR EQUAL TO 4 YEARS | 20% | 30% | 20% |

| 3) LESS OR EQUAL TO 5 YEARS | 15% | 30% | 15% |

| 4) MORE THAN 5 YEARS | 5% | 10% | 10% |

How it is calculated, and what kind of impact does it have on you?

Based on the Real Property Gains Tax Act 1976, RPGT is a tax on chargeable gains derived from the disposal of property. A chargeable gain is a profit when the disposal price is more than the purchase price of the property. What most people don’t know is that RPGT is also applicable in the procurement and disposal of shares in companies where 75% of their tangible assets are in properties, a.k.a. Real Property Companies (RPC). RPGT applies to both residents and non-residents.

You will be only be taxed on the positive net capital gains which are disposal price less the purchased price less the miscellaneous charges such as stamp duty, legal fees, advertisement charges, etc. Additionally, a waiver on the taxable amount is granted to individuals (but not companies). The holding period is from the date on the Sales and Purchase Agreement (S&P) until the disposal date.

For a quick calculation, the formula is:

Chargeable Gain = Disposal Price – Purchased Price – Miscellaneous Costs

Net Chargeable Gain = Chargeable Gain – Exemption Waiver (RM10,000 or 10% of Chargeable Gain, whichever is higher)

Tax payable = RPGT Rate (based on holding period) * Net Chargeable Gain

If you’d like for a simpler way to compute your RPGT, why not check out this handy calculator which will save you the hassle!

If you want to see a real example, here you go:

Let’s say you purchased a house 12 year ago for RM500,000, now you want to sell it. The market price of the house is now RM700,000. To calculate the chargeable gain we minus the price RM700,000 by the original purchase price RM500,000 and any miscellaneous cost, let’s say we incurred a miscellaneous cost of RM10,000 from lawyer fees. The calculation goes as follows:

Chargeable Gain = Disposal Price – Purchased Price – Miscellaneous Costs

= RM700,000 – RM500,000 – RM10,000

= RM190,000

Now, we move onto the net chargeable gain. As mentioned above we can deduct the exemption waiver.

Net Chargeable Gain = Chargeable Gain – Exemption Waiver (RM10,000 or 10% of Chargeable Gain, whichever is higher)

= RM190,000 – (RM190,000 X 10%)

= RM171,000

Tax payable = Net Chargeble Gain X RPGT Rate (based on holding period)

= RM171,000 X 5%

= RM8,550

You’ll pay the RPTG over the net chargeable gain. If you owned the property for 12 years, so you’ll need to pay RPGT of 5%.

RPGT Exemptions

Good news! There are some exemptions allowed for RPGT. Among the exemptions are:

- Exemption on gains from the disposal of one private residential property once-in-a-lifetime to an individual (please utilise this once in lifetime opportunity wisely).

- Exemption on gains arising from the disposal of real property between family members (e.g. husband and wife; parents and children; grandparents and grandchildren).

- 10% of profits OR RM10,000 per transaction (whichever is higher) is not taxable.

- Low cost, low-medium cost and affordable housing priced below RM200,000 will be exempted from RPGT.

RPGT Exemption Order 2020 (“Exemption Order”)

Announced during PENJANA 2020, under the Exemption Order, gains arising from the disposal of residential properties after 1 June 2020 until 31 December 2021 will be exempted from RPGT. Such exemption is granted for up to three residential properties per individual if the following conditions are fulfilled:

1. the disposer must be an individual who is a Malaysian citizen and is the sole or joint owner of the property to be disposed;

2. the property disposed must be a ‘residential property’, namely a house, a condominium unit, an apartment or flat in Malaysia, and includes a service apartment and a small office home office (SOHO) which is used only as a dwelling house;

3. the residential property which is being disposed of is not acquired by way of:

- transfer between spouses; or

- a gift between spouses, parent and child, or grandparent and grandchild where the donor is a citizen; and

4. the SPA for the disposal of the residential property is executed on or after 1 June 2020 but not later than 31 December 2021 and is duly stamped not later than 31 January 2022. Where there is no SPA, the instrument of transfer for the disposal of the residential property is executed on or after 1 June 2020 but not later than 31 December 2021, and is duly stamped not later than 31 January 2022.

Where an individual disposes of more than three units of residential properties, the disposer may elect any three from the said disposals to be exempted. Once the decision is made, the election is final and irrevocable.

In the event the disposal of the residential property is a conditional contract requiring the Federal Government or a State Authority’s approval, the exemption will be applicable subject to the following conditions:

- the contract of disposal of a residential property is executed on or after 1 June 2020 but not later than 31 December 2021 and is duly stamped not later than 31 January 2022; and

- the approval is obtained on or after 1 June 2020.

Similar to the stamp duty exemptions under HOC, it appears that the RPGT Exemption is only given to Malaysian citizens. Currently, the applicable RPGT rates for Malaysian citizens and permanent residents range from 5% to 30% depending on the holding period.

RPGT amendment under Budget 2020

As per the Budget 2020 announcement, the government had revised the RPGT imposed on the disposal of properties after a five-year period, by individual citizens and permanent residents, by setting the market value on 1 January 2013 as the property acquisition price for properties acquired before the said date, compared to the current base year of 1 January 2000.

This means property owners will have lower tax payment especially to those who bought the property before 1 January 2000.

For a clearer picture, take a look at below scenario as an example:

Jared bought a house in 1990 for RM150,000. In January 2020, he sold it for RM600,000.

Let’s assume that the market price on 1 January 2000 was RM300,000, while the market price for 1 January 2013 was RM480,000. The following is a calculation of RPGT without regard to other costs that are eligible for deduction.

Before Budget 2020:

RM600,000 – RM300,00 = RM300,000

RPGT = RM300,000 x 5% = RM15,000After Budget 2020:

RM600,000 – RM480,000 = RM120,000

RPGT = RM120,000 x 5% = RM6,000As you can see, Jared saved RM16,500. That’s a lot!

According to The Edge, the Malaysian Institute of Estate Agents’ (MIEA) immediate past president, Eric Lim shared that by moving the base year, property owners will be able to sell and upgrade. Hence, it’ll encourage some market activity. Aside from upgraders, it’s also good for investors because they can cash out and change to something else. He adds that this will benefit the secondary market.

That aside, there’s one more question that’s yet to have an accurate answer: How or who is entitled to do market valuation of the property? So far we know the Inland Revenue Board of Malaysia (IRBM) will take the property market value from the Valuation and Property Services department (JPPH).

Take note, that this matter is still in the parliamentary approval stage, no official gazette has yet been reached.

SIDE NOTE: For a quick calculation of RPGT, please use Loanstreet’s RPGT calculator to get more accurate results. Also, the process of getting a loan for a property is a complex and tedious one. But, don’t worry! Utilise our Home Loan Comparison tool to find out which loan is the best fit for you!