Real Property Gains Tax (RPGT) in Malaysia (2022)

UPDATED 25 FEB 2022 – BY TEAM LOANSTREET : https://loanstreet.com.my/learning-centre/rpgt-in-malaysia

Real Property Gains Tax (RPGT) is a form of Capital Gains Tax that homeowners and businesses have to pay when disposing of their property in Malaysia. This means that if one day you decide to sell your house, you have to pay taxes on the profit (gains) if you have any.

If you sell your house with a loss you don’t have to pay any RPGT because you didn’t make any profit. If you made a profit you need to make sure you pay the RPGT within 60 days of the sale. You can pay the RPGT by paying a fee for the solicitors of the sale. Paying yourself is also possible if you prefer that instead of dealing with a lawyer you can fill in the necessary forms for the Inland Revenue Board. Further in the article, we will talk about handy tools, how it is calculated and exemptions.

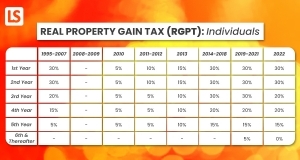

Now, here is some history about the RPGT. First, it was suspended temporarily from April 2007 to December 2009 and reintroduced in 2010. In 2014, the RPGT was increased for the fifth straight year since 2009. In 2019, the RPGT rates have been revised. Then, there’s another revision to the RPGT under Budget 2020, as well as the Exemption Order for 2020. Additionally, under Budget 2022, Finance Minister Tengku Zafrul announced that the government will no longer impose Real Property Gains Tax or RPGT for property disposals by individuals comprising Malaysian citizens, permanent residents and foreigners starting from the sixth year.

But first…

RPGT rates classification

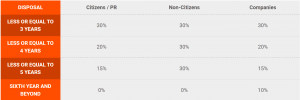

The following is the RPGT rates effective from January 2022:

RPGT amendment under Budget 2022

As per the Budget 2022 announcement, individuals who are Malaysian citizens and permanent residents will benefit from the removal of the Real Property Gains Tax (RPGT) on the disposal of any residential property in the sixth year of ownership and beyond.